Vendor Finance on Aore Island, Vanuatu

A 25-Year Track Record of Access, Flexibility, and Delivery

Share

Thesis: Vendor finance isn’t a loophole on Aore Island—it’s the operating system. Since the late 1990s, sellers and local landholding entities have used vendor finance to open real estate ownership to everyday buyers who couldn’t or wouldn’t use offshore bank lending. The result: a durable, community-scaled model with a documented record of buyers taking possession, building, and—crucially—finishing their payments.

This piece examines how the system works, the terms people actually agree to, why defaults don’t typically end in disaster, and what “success” has meant on the ground for hundreds of participants.

The Origin Story: Why Vendor Finance Took Root

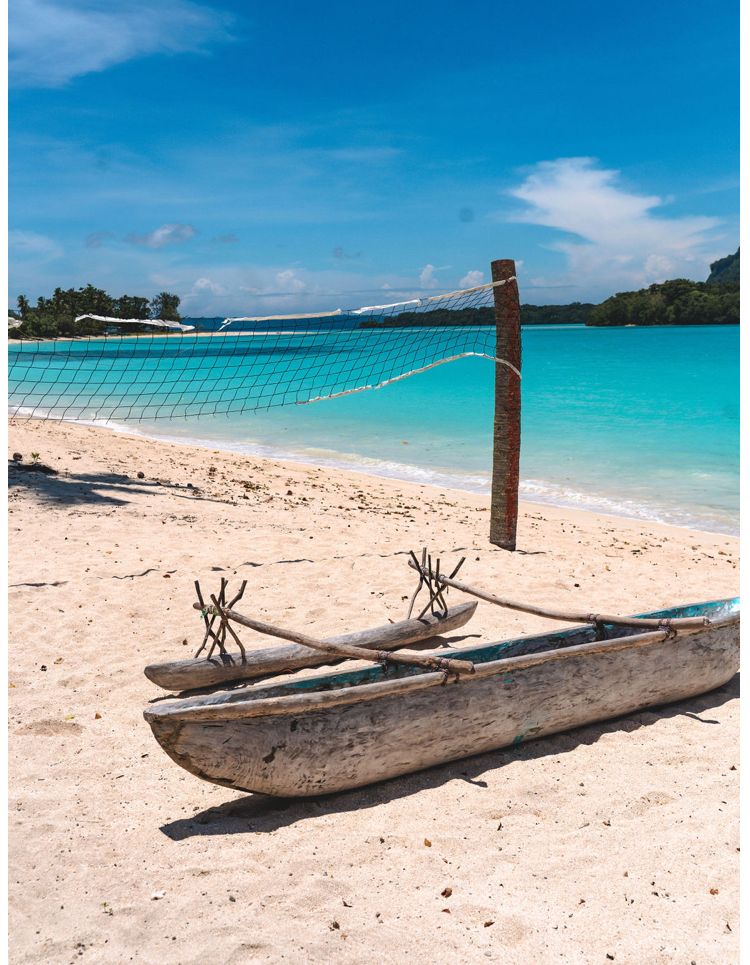

Aore Island sits off Espiritu Santo in northern Vanuatu—gorgeous, close to Luganville, but historically underserved by mainstream lenders. Through the late 1990s and 2000s, foreign banks were reluctant to write small or mid-size loans over leasehold property in Vanuatu, and when they would, fees and friction were high. Vendor finance filled the gap:

- Speed to agreement: Buyers negotiate directly with the landholder or vendor, not a bank credit committee.

- Fit-for-purpose terms: Payments are structured to match household income, offshore earnings, or seasonal cashflow.

- Lower barrier to entry: Many buyers start with modest weekly payments while they plan a build or relocation.

Over time, this shifted from “exception” to “standard pathway”—particularly for blocks under active subdivision programs and lifestyle parcels marketed to long-term settlers.

Explore Vanuatu Tours Across Santo, Aore, and Beyond

Discover the best Vanuatu holidays with island tours, resorts, and authentic local experiences. From Aore Island getaways to Santo adventures, explore why Vanuatu is one of the South Pacific’s top travel destinations.

The Core Mechanics: How Deals Are Structured

Parties: the vendor (custom owner/leaseholder or their company) and the buyer (individuals, family trust, or company).

Security & paperwork: Buyers typically execute a sale contract with a vendor-finance schedule plus a transfer arrangement tied to completion. In many cases, buyers also receive possession rights (to maintain, fence, or begin staged works) as they perform.

Payment frames observed on Aore Island (illustrative ranges):

- Entry-level inland blocks (sub-$50k): common minimum commitment around from $200/week.

- Mid-tier lifestyle blocks: $300–$600/week, often with flexibility for seasonal or FIFO income.

- Premium/beachfront blocks: up to $1,000/week when buyers want a faster payoff calendar or a larger parcel.

Deposits vary—by design. The entire point is tailoring:

- No-deposit / low-deposit deals exist when the buyer’s weekly capacity is strong and verifiable.

- High-deposit / low-weekly options suit buyers with lump-sum cash who want minimal ongoing strain.

- Typical term length: 1–5 years, driven by price, cashflow, and build plans.

Interest policy: the local convention on many Aore deals is no interest while the buyer performs. If the buyer falls into material default, interest may be triggered on arrears as a deterrent and to cover carrying costs. This “perform = no interest” norm is a powerful compliance lever and a real affordability win for households.

Living in Vanuatu: Lifestyle, Costs, and Culture

Life in Vanuatu is slower, safer, and cleaner than many crowded tourist destinations. With fresh local food, a welcoming community, and direct links to Australia and New Zealand, the lifestyle here offers a balance of affordability and true island living.

Default, Resale, and Why the Model Stays Stable

Every finance model has defaults. What’s unusual on Aore is how defaults are managed:

- If a buyer disappears or cannot recover: the parcel is resold.

- Funds returned net of costs: Buyers who have paid in but don’t complete typically have payments returned less up to 20% (treated as a non-refundable component to cover admin, marketing, and opportunity cost) and less any agreed fees.

- Land stays productive: Inventory cycles back to market quickly; vendors avoid long, dead periods; incoming buyers step into a clean slate.

The system’s resilience comes from velocity (resale demand) and alignment (no-interest while performing). It’s hard to overstate how much this aligns incentives: vendors want steady weekly performance; buyers want zero interest; both want quick recovery if life goes sideways.

Outcomes on the Ground

Completion, Building, and Multi-Parcel Buyers

Over the last two-plus decades, hundreds of buyers have used vendor finance to enter the Aore property market. Patterns that emerge:

- High completion rates: The community reports a near-perfect record of buyers who stay current through term and take title at completion. Internally, stakeholders describe a “100% success rate” for buyers who remained in contact and performed to schedule i.e., no completed-performance buyer failed to receive what was contracted.

- Repeat purchasers: Once buyers see the model work, many pick up a second or third block (for family, investment, or a future build stage).

- Build momentum: Staged development power, water solutions, gardens, fencing, docks often begins before final payoff, compounding commitment.

Why It Works Here (and Doesn’t Everywhere)

- Tight feedback loops: Small community, short decision chains, and face-to-face accountability.

- Real demand: Aore supplies lifestyle blocks with reef, soil, and access scarce elsewhere at similar price points.

- Transparent math: Weekly affordability is clear; buyers choose their path (bigger deposit or bigger weekly).

- Cultural norm: After 25 years, vendor finance isn’t experimental. It’s the “expected” conversation starter.

The Negotiation Playbook Buyers Actually Use

- Know your weekly ceiling. Commit to a number you can hit in bad months, not just the good ones.

- Trade levers, not promises. If you want a shorter term, lift your weekly. If you want a lighter weekly, raise your deposit.

- Align term to a milestone. Many buyers set 36–60 months to dovetail with visa plans, school cycles, or a build schedule.

- Ask for interest-free while performing. This is common; vendors usually agree document it clearly.

- Get clarity on default math. If life happens, what gets kept (up to 20%), what gets returned, is the balance of the purchase price and how fast is resale actioned?

Risk Controls That Keep Everyone Honest

- Documentation: Use a clear sale contract with a vendor-finance schedule and default remedies that are balanced and transparent.

- Receipting: Weekly payments receipted promptly; buyers keep their own ledger.

- Milestone checks: Quarterly check-ins catch issues early.

- Resale protocol: Pre-agreed, time-boxed steps if a buyer signals distress—this protects value and speeds refunds.

Case Snapshots (Composite, anonymised)

- The FIFO Couple: Entered with $5k deposit, $450/week, 48-month schedule. Paid off 14 months early after a contract bonus; began a small build in year two.

- The Family Upsizer: Started no-deposit at $220/week on a sub-$50k inland block; added a second block in year three once the first was nearly cleared.

- The Beachfront Planner: Put $20k down, then $1,000/week for a premium shoreline parcel targeted a 24-month payoff to begin a high-spec build with cash.

Latest property for sale

Myths vs. Reality

- Myth: “Vendor finance is risky because there’s no bank.”

Reality: The risk moved from “bank says no” to “clear, bilateral performance.” With receipts, milestone check-ins, and a resale/refund protocol, the practical risk for a performing buyer is low and the upside (interest-free while current) is high. - Myth: “If I default once, I lose everything.”

Reality: Occasional late payments are cured all the time. Only material default triggers remedies. On genuine withdrawal, resale and refund less up to 20% is standard—documented upfront. - Myth: “These deals are one-size-fits-all.”

Reality: The entire model is custom—deposit, weekly amount, and term are dialled to the buyer’s budget.

What “Success” Actually Means in This Market

When island communities say “100% success rate,” they aren’t claiming zero hiccups. They’re pointing to a quarter-century of buyers taking possession and completing when they stay engaged and perform and to orderly exits when they can’t, with land rapidly resold and funds returned net of the agreed retention. In practice, that’s what sustainable access looks like.

Buyer Checklist: Execute Like a Pro

- Confirm title & boundaries: Ensure the lease details match the marketing plan; keep copies.

- Lock the finance schedule: Deposit, weekly amount, term, interest-only-on-default clause in black and white.

- Define default cure windows: How many days? What’s the re-set process?

- Pre-agree resale & refund math: If you must exit, you know the steps and timelines.

- Set reminders: Automate weekly payments; ask for monthly statements.

- Plan the build: Start with low-capex wins—fencing, soil prep, water solutions—so momentum survives life hiccups.

- Think ahead: If you’re eyeing multiple blocks, ladder the terms so payoffs don’t peak in the same quarter.

The Bottom Line

Vendor finance on Aore Island is not a marketing gimmick; it’s a tested affordability engine. The combination of interest-free performance, flexible deposits, realistic weekly payments ($200–$1,000), and 1–5 year terms has enabled hundreds to secure land and, in many cases, multiple parcels. Defaults haven’t broken the system because resale is brisk and refunds (less up to 20%) are pre-agreed, keeping capital circulating and trust intact.

For buyers who want island land without navigating offshore bank hurdles, this is the mature, local pathway transparent, negotiated, and built for completion.

Watch videos on youtube

Contact Us

Latest Articles on Vanuatu

Stay up to date with the newest insights on Vanuatu property, business, and lifestyle. From affordable land tips to investment guides, these articles keep you informed and ready to take action.