Share

7 min Read

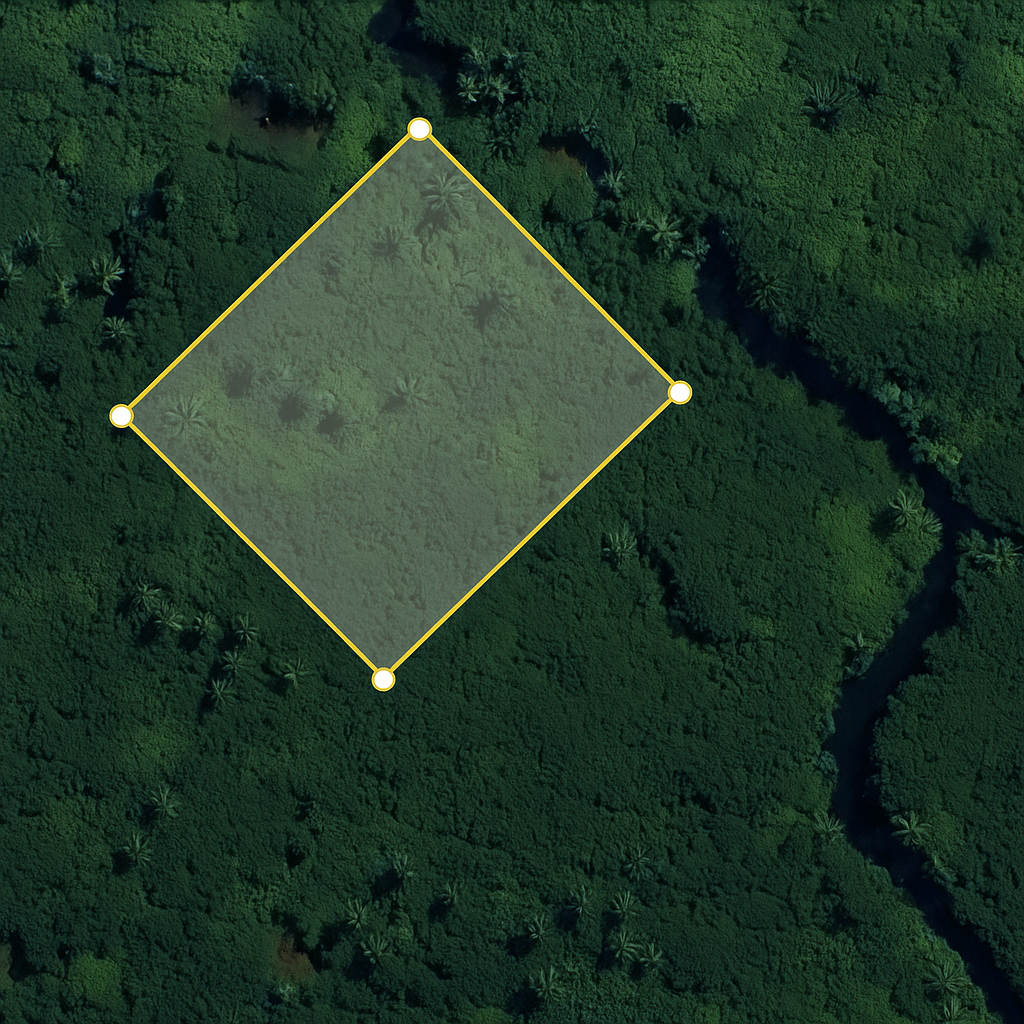

Buying Property in Vanuatu

Everything Foreign Investors Need to Know

Vanuatu is quickly becoming one of the most attractive destinations in the South Pacific for lifestyle buyers, retirees, and international investors. With its tropical climate, stunning beaches, and relaxed way of life, many people are asking the same question: Can foreigners buy property in Vanuatu? The answer is yes. In this guide, we’ll cover everything you need to know about buying property in Vanuatu, including leasehold land, steps in the purchase process, costs, capital gain potential, and property management.

Can Foreigners Buy Property in Vanuatu?

Yes. Foreigners can buy property in Vanuatu without restrictions. Unlike many countries that impose residency or citizenship requirements, Vanuatu allows non-citizens to purchase property.

For urban property purchases (such as in Port Vila or Luganville), a non-citizen may be asked to provide:

- A financial reference

- A professional reference from a local firm

These are straightforward requirements, and they are the only distinctions made between citizen and non-citizen buyers.

Importantly, you do not need a Vanuatu Investment Promotion Authority (VIPA) Investor’s Certificate or a business license to buy residential property in Vanuatu. You only need these approvals if you are buying an existing business.

Is There Freehold Land in Vanuatu?

No. All land in Vanuatu is leasehold, not freehold.

Under the Land Reform Act of 1980, the urban areas of Port Vila and Luganville were declared public land. In these cases, the Minister of Lands acts as the lessor. In rural areas, leases are usually created with customary landowners, though the Minister may still act as lessor where ownership is not yet established.

Do You Need to Live in Vanuatu to Own Property?

No. Property ownership is open to both residents and non-residents. Many foreign investors purchase property in Vanuatu for holiday homes, investment purposes, or retirement planning without living full-time in the country.

Steps in Buying Property in Vanuatu

The process of buying property in Vanuatu is straightforward, usually taking between 1 and 3 months. Here are the normal steps:

- Sign a Sale and Purchase Agreement and pay the deposit (usually 10%) into the agent’s or solicitor’s trust account.

- Meet contract conditions, if any apply.

- Vendor applies for Lessor’s Consent to Transfer or arranges for a share transfer.

- Pre-settlement inspection of the property or title search by the purchaser’s side.

- Settlement occurs. The purchaser receives:

- Three original Transfer of Lease deeds executed by the vendor

- Copy of Registered Title

- Settlement Statement

- Current Property Tax receipt

- Current Land Rent receipt

- Tenancy Agreement (if applicable)

- Company documentation (if applicable)

At this stage, you are the registered owner (lessee) of your Vanuatu property.

Leasehold Titles in Vanuatu

- Maximum term: 75 years (as set by the Constitution).

- Many leases created around Independence in 1980 were 50 years.

- All new leases today are registered for 75 years.

When buying an existing lease, you purchase the remaining term, not a fresh 75 years. However, under the Land Lease (Amendment) Act of 2003, urban lessees can renew their leases back to 75 years upon paying a premium and administrative fees. Leases can also be surrendered for rezoning, subdivision, or extension.

Can You Buy Apartments or Commercial Strata?

Yes. The Strata Title Act of 2000 allows the creation of strata titles for apartments, commercial buildings, and mixed-use developments. This makes investing in urban property more flexible, especially for buyers looking at rental income or commercial opportunities.

LATEST PROPERTIES FOR SALE

Costs of Buying Property in Vanuatu

Typical buyer’s costs include:

- Stamp Duty: 2%

- Title Transfer Registration: 5%

- Legal Fees: 0.5% – 1% of purchase price

If buying a company instead of the lease title, Stamp Duty is 4% on the share transfer value, and no 2% duty applies.

Vendor’s costs are generally limited to agent’s commission and legal fees.

Financing and Mortgages

Commercial banks in Vanuatu accept leasehold titles as security.

- Residential loans: usually require 20% deposit

- Commercial loans: up to 50% deposit

Mortgages and cautions are registered against titles in the same way as other countries.

Capital Gains and Market Growth

Capital growth varies by location:

- Beachfront property and vacant land in prime areas show the highest gains.

- Ocean-view sites with good water and sunset aspects have performed well.

- Some areas have seen 10–25% growth per year, while others remain closer to 5% annually.

Renting Out Property in Vanuatu

The rental market is strong, especially in Port Vila and Luganville. Aid organizations, expatriates, and foreign companies often prefer renting on 1–3-year leases.

Typical rents:

- Standard family homes: AUD 1,200 – AUD 2,000/month

- High-end properties: higher rates depending on location and amenities

Property management is available, usually costing up to 7% of gross rent plus VAT.

LIFESTYLE ARTICLES ABOUT VANUATU

Building a Home in Vanuatu

Yes, foreigners can build. You don’t need a business license to build your own house, but you do need:

- Planning permission

- Building permit

- VNPF registration if you employ workers

Cost to build: AUD 1,200 – AUD 1,800 per m², depending on finishes.

Taxes and VAT on Property

- Residential sales: No VAT payable by purchaser.

- Commercial property: VAT (12.5%) may apply unless vendor is not VAT-registered.

- Outgoings:

- Municipal property tax (urban)

- Lease rent (~AUD 500 per acre per year)

- Insurance (0.5%–0.7% of insured value)

- Rent tax on residential property (12.5% of gross rent)

Insurance and Approvals

Insurance policies cover cyclone, earthquake, fire, theft, and liability. A cyclone insurance policy requires an engineer’s certificate.

For waterfront property: reclaiming land or building a jetty requires multiple approvals, including Foreshore Development Act approval, municipal or provincial permissions, and in some cases, an environmental study.

Currency and Transactions

Property can be sold in any currency agreed upon by both parties. There are no restrictions on bringing foreign currency in or out of Vanuatu.

Key Warnings: Customary Land

Unregistered customary land cannot be sold. Only registered leasehold titles can be transferred. Always seek professional legal advice to avoid disputes with customary ownership.

Why Invest in Vanuatu Property?

- Foreigners can own property without restrictions

- Leasehold terms up to 75 years, renewable

- Strong capital growth in prime areas

- Reliable rental market supported by aid organizations and expatriates

- Affordable build costs compared to Australia and New Zealand

- Safe, simple, and transparent property process

Final Thoughts

Buying property in Vanuatu offers lifestyle, investment potential, and security. With clear rules, renewable leases, and no residency requirements, it is one of the easiest places in the Pacific for foreigners to invest. Whether you are seeking a beachfront holiday home, an apartment investment, or land to build your dream retirement villa, Aore real estate provides an opportunity to own a slice of paradise.