How Much Do Custom Owners Really Earn From Land in Vanuatu? A Reality Check (Aore Island Focus)

Share

by Justine Murray - Aore Real Estate

Custom ownership is the backbone of Vanuatu’s land system. Under the Constitution, land belongs to indigenous custom owners and their descendants, and leasehold is the main pathway for development and “land sales” in practice. What most buyers call a “land sale” is usually the purchase of a lease (often 50–75 years), not freehold.

So the commercial question becomes simple:

How much cash do custom owners actually generate over time from leasing land and from resource activity on that land and sea?

This article breaks it down using the best public numbers available, then applies a practical revenue model to Aore Island (Sanma Province), where leasing and subdivision activity is unusually concentrated.

Step 1: Understand the 3 cash flows that matter

1) Lease premium (the upfront payment)

When a lease is first created over customary land, the lessee typically pays an upfront premium to the custom owners (often via the agreed process/structures in that area). That premium is the “headline” number people talk about.

Important commercial reality:

After the lease exists, most re-sales are between leaseholders. The custom owners usually don’t get paid again unless there’s a renegotiation, extension/renewal, variation, or a new lease is created.

2) Annual ground rent (the ongoing payment)

This is usually modest in Vanuatu compared with Australia. Some sources describe annual lease rent in the low hundreds of AUD depending on location and deal terms.

vanuatuisland.org

Industry FAQs also describe rural renewal fees that can range from a one-off payment (example: VT30,000) up to a percentage of unimproved value, depending on the lessor and lease structure.

firstnationalsanto.com

3) Renewals, extensions, and renegotiations (the “second bite”)

Urban renewals can be calculated as a percentage of unimproved land value (with government valuation involved), and rural renewals vary by negotiation.

firstnationalsanto.com

This is where custom owners can capture additional value later in the lease lifecycle, especially where the land has become more valuable due to subdivision, roads, tourism demand, or services.

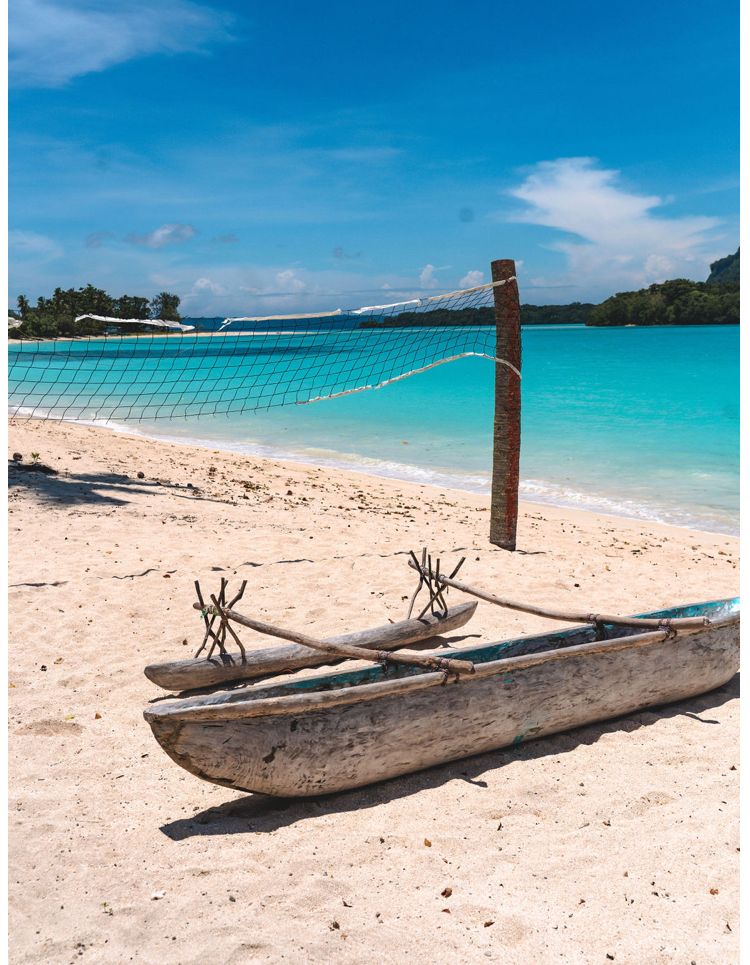

Explore Vanuatu Tours Across Vanuatu

Discover the best Vanuatu holidays with island tours, resorts, and authentic local experiences. From Aore Island getaways to Santo adventures, explore why Vanuatu is one of the South Pacific’s top travel destinations.

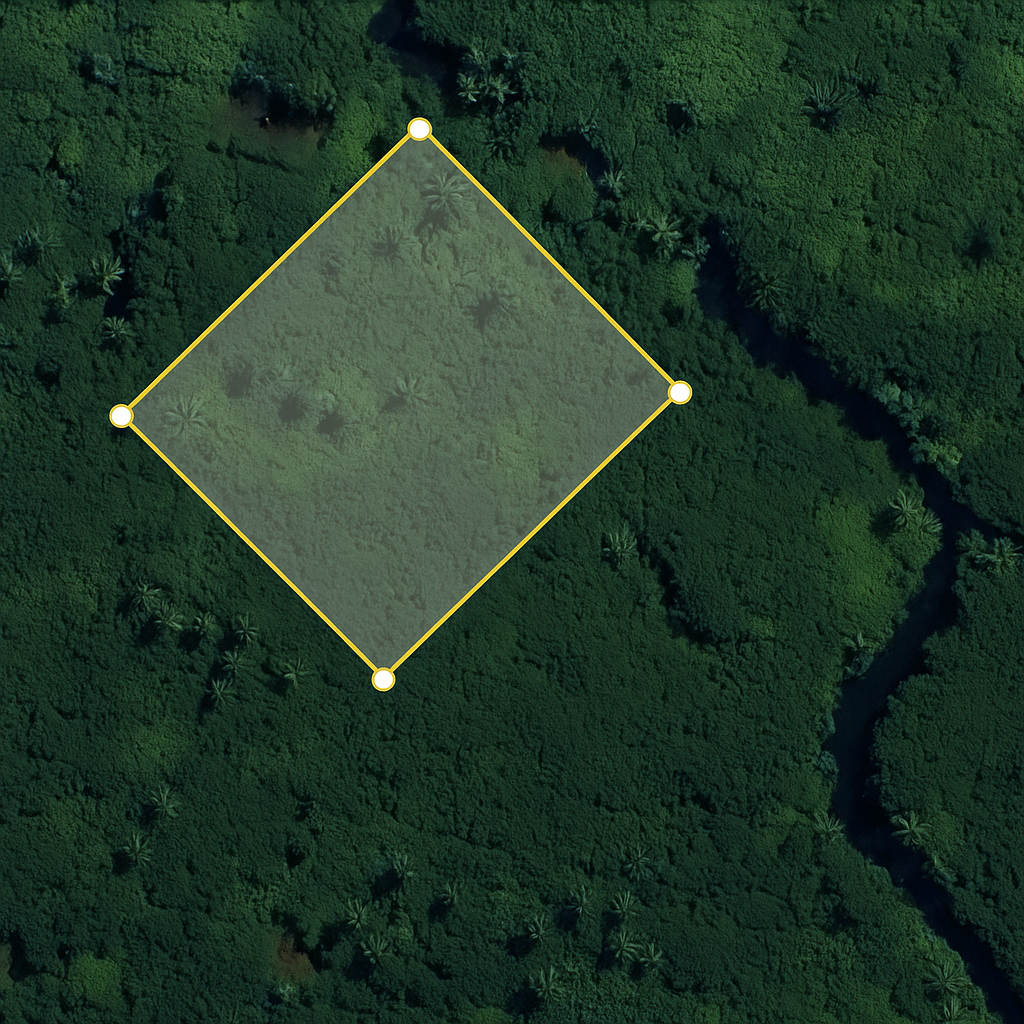

Step 2: Aore Island is not “normal” Vanuatu it’s lease-dense

A World Bank leasing profile identified Aore Island as having 291 leases and around 65.3% of the island under lease, with heavy subdivision activity (84% of Aore’s leases in that dataset were subdivisions). World Bank

That matters because subdivision turns one negotiation into many “saleable” blocks, and it increases the number of points where money can flow (premiums, rent streams, and later variations).

Step 3: What does “average land sale” look like on Aore?

Looking at current Aore-style pricing examples (lease purchase prices), it’s common to see beachfront and near-beach parcels marketed from about USD/AUD-equivalent tens of thousands up into the hundreds of thousands depending on frontage, access, and readiness.

For example, on Aore listings:

- A smaller “near beach” style parcel advertised around $40,000

- A beachfront block marketed around $120,000 vanuatuisland.org

- A premium “ready to build” beachfront offering around $220,000

Market reality:

Those are asking prices, and they’re not the entire market. But they are directionally useful for modelling what a subdivision-driven island can generate when blocks are actively being traded.

Step 4: A practical earnings model for custom owners on Aore (range-based)

Because Vanuatu lease payments are private contract terms in most cases, there is no single public database of “what custom owners get paid per block.” So the only honest way to answer is with a range model and clear assumptions.

Here’s a commercially realistic framework that investors and families can understand.

Aore baseline: number of leases

Aore leases count: 291.

Not all 291 are separate “houses.” Some are agriculture, tourism, access, and administrative leases. But the subdivision ratio is high, meaning many are small plots. (World Bank)

Scenario assumptions (transparent)

To avoid fantasy numbers, I’ll model three tiers:

Tier A (Conservative):

- Only 20 new leases/plots created or sold in a 10-year window

- Average premium equivalent: $60,000

- Annual rent: $250

Tier B (Base case):

- 40 new leases/plots in 10 years

- Average premium: $100,000

- Annual rent: $300

Tier C (Growth case):

- 60 new leases/plots in 10 years

- Average premium: $140,000

- Annual rent: $400

These premium bands align with the type of pricing commonly seen on Aore blocks (tens of thousands to low hundreds of thousands).

Annual rent in the low hundreds (AUD) aligns with commonly stated ranges for ground rent.

vanuatuisland.org

What the numbers look like (10-year view)

Tier A (Conservative)

- Premium revenue: 20 × $60,000 = $1.2M

- Rent revenue: assume 200 active rent-paying leases × $250 × 10 years = $500,000

Indicative 10-year total: $1.7M

Tier B (Base)

- Premium revenue: 40 × $100,000 = $4.0M

- Rent revenue: 220 leases × $300 × 10 years = $660,000

Indicative 10-year total: $4.66M

Tier C (Growth)

- Premium revenue: 60 × $140,000 = $8.4M

- Rent revenue: 250 leases × $400 × 10 years = $1.0M

Indicative 10-year total: $9.4M

Living in Vanuatu: Lifestyle, Costs, and Culture

Life in Vanuatu is slower, safer, and cleaner than many crowded tourist destinations. With fresh local food, a welcoming community, and direct links to Australia and New Zealand, the lifestyle here offers a balance of affordability and true island living.

Step 5: “Custom rents” in plain English

When people say “custom owners collect rent,” they usually mean one or more of the following:

- Annual ground rent paid by the leaseholder (small but steady) vanuatuisland.org

- One-off payments for renewal/extension or negotiated variations (can be meaningful) firstnationalsanto.com

- Local user charges: access, easements, tourism entry, or service agreements tied to land use (highly variable, often informal)

The critical point:

If the island has 291 leases, even small annual rents compound into a real operating income line for the landholding group — if collection is consistent and disputes are controlled.

World Bank

Step 6: Resource money: fishing, timber, milling, sand, quarry

This is where most online commentary gets messy, because people mix up:

- customary fishing rights (community control),

- government waters,

- commercial licensing, and

- royalties paid under specific Acts.

Here’s the clean breakdown.

Fishing (coastal and commercial)

Coastal fishing is often governed through customary practice and local management. “Artisanal fishing” is explicitly described as fishing by customary resource owners for household consumption, barter, or domestic market trade. Natlex

Where “money” shows up is typically:

- selling fish locally (household micro-economy)

- community-agreed access arrangements (case-by-case)

- commercial licensing in the formal offshore sector (mostly government-administered)

For example, fisheries regulations include value-based fees for certain foreign or locally-based foreign fishing activity (example: up to 5% of catch value in a specified category). Fisheries Vanuatu

That is not automatically “paid to custom owners,” but it shows the scale of formal value capture mechanisms in the sector.

Practical reality for Aore:

Most direct custom-owner fishing income tends to be local-market trade and informal access arrangements, unless there is a structured enterprise (ice, transport, processing, contracts).

Timber, milling, and forestry royalties

Forestry regulations require permit holders to pay royalties payable on timber felled to the custom owners of the land concerned within set payment periods. ADB Law and Policy Reform Program

What’s missing publicly in many cases is a single, easy “royalty per cubic metre” number that applies everywhere. Rates can differ based on species, permit terms, and enforcement.

Practical reality:

Timber money can be material in cash terms, but it is also the highest-risk category reputationally and legally because it intersects with sustainability, permitting compliance, and intra-community disputes.

Sand, quarry, and aggregates (royalties)

This is the most “documented” resource flow because it’s linked to infrastructure projects and quarry permitting.

The Quarry Act establishes royalty obligations and the concept of payment to custom owners in specified circumstances (for example, where custom owners do not hold sufficient shares in a quarry company).

FAOLEX

There are also real court disputes and judgments that reference royalty rates per cubic metre in practice (examples referenced in decisions include VT50 and VT150 per cubic metre in particular contexts).

Practical reality:

If sand/aggregate extraction is active, it can become one of the few consistent “cash generating” lines outside lease premiums. But it must be managed like a business unit: measurement, invoicing, reconciliation, distribution rules, and dispute controls.

Latest property for sale

Step 7: The real “average” over years is not one number — it’s a portfolio

Custom owner earnings behave like a portfolio with three buckets:

Bucket 1: Capital events (premiums)

Big spikes. Not frequent unless subdivision is active.

Bucket 2: Yield (ground rent + renewals)

Smaller numbers, but stable and bankable if collected properly.

vanuatuisland.org+1

Bucket 3: Resource royalties + local enterprise

Highly variable. Can be meaningful where there’s quarrying or structured forestry; otherwise mostly micro-economy scale.

judiciary.gov.vu+3FAOLEX Database+3ADB Law and Policy Reform Program+3

Aore Island, with 291 leases and high subdivision concentration, is structurally positioned to outperform “average islands” in Bucket 1. World Bank

Step 8: The governance issue that decides whether money turns into wealth

Two islands can generate the same premium income and end up in completely different places.

The difference is governance:

- A formal entity (trust, association, company, committee) with rules

- Transparent distribution policy (what gets paid out vs reinvested)

- A dispute mechanism before disputes explode

- A community reinvestment plan (roads, water, wharf access, schooling, clinic support)

Without this, premium-driven cash tends to behave like a one-off payout cycle, not long-term wealth creation.

Bottom line: What custom owners on Aore can realistically generate

Based on:

- Aore’s unusually high lease concentration (291 leases; ~65% under lease; subdivision-heavy) World Bank

- observed Aore market pricing examples (tens of thousands to low hundreds of thousands per block/lease)

- typical low annual ground rents in many lease structures vanuatuisland.org

- real royalty mechanisms for quarrying/aggregates and forestry payments to custom owners (ADB Law and Policy Reform Program+3FAOLEX Database)

A commercially defensible estimate is:

Over a 10-year horizon, an active Aore customary landholding group can generate low single-digit millions up to high single-digit millions (AUD-equivalent) primarily through lease premiums, with steady but smaller rent income, and potentially meaningful upside from quarry/sand activity where it exists and is managed properly.

On a good year on Aore, custom owners typically make money from (1) new lease premiums + (2) annual ground rent.

Good-year range (realistic)

- $0.3M–$1.0M AUD in a strong, normal “active sales” year

- $1.0M–$2.5M+ AUD only in a boom year (multiple beachfront blocks / major subdivision stage / big deal closes)

What that looks like in practice

- If 6 new blocks are leased/created in a year at ~$140k average premium = $840k

- Plus rents across ~200–250 leases at

$250–$400/yr =

$50k–$100k

So a clean “good year” target is about $900k–$1.0M AUD.

The President of Vanuatu earns about Vt 67,846 per week, which is roughly USD 32,300 per year in salary. That role is largely ceremonial. Wikipedia

Official pay rules also state the President is entitled to the same salary/entitlements as the Prime Minister under national salary legislation. grt.gov.vu

So custom owner do well in the reality of Vanuatu

FAQ Land leases

What are the benefits of a land lease for buyers?

What are the benefits of a land lease for buyers?

A land lease gives buyers secure, legal use of land for a fixed term without purchasing it outright. It provides a clear, registered interest, lower entry cost than freehold, and the ability to build, live, farm, or operate a business while respecting local ownership.

How does leasing land benefit buyers long term?

How does leasing land benefit buyers long term?

Leases offer certainty, protection under law, and long planning horizons. Buyers can invest, develop, and generate returns over decades, while operating within a system that protects culture and ensures stability.

Can land in Vanuatu be sold to foreigners?

Yes land leases can be sold .

Custom land always stays with ni-Vanuatu families. What is offered is a lease, not ownership.

Who owns the land during a lease?

Who owns the land during a lease?

The custom owners. The land never changes hands. The lesasee has right of use and is protected by the law for peacful enjoyment

Why does Vanuatu use land leases?

Leases allow communities to benefit from development while protecting culture, heritage, and long-term ownership. It creates generational wealth

How long are land leases?

How long are land leases?

Most leases are for a fixed period, commonly 50 to 75 years.

Do custom owners choose to lease their land?

Do custom owners choose to lease their land?

Yes. Leases are entered into by custom owners and formally registered under Vanuatu law.

How do local families benefit from leases?

How do local families benefit from leases?

Through lease premiums, ongoing ground rent, employment, infrastructure, and long-term improvements to their land.

What happens at the end of a lease?

What happens at the end of a lease?

The lease finishes and the lease negtioates a further lease. Otherwise the custom owner has t buy the land back at marlet value and the land returns to the custom owners, often improved and serviced who usually do not want to do this as they enjoy a passive income and owning the lands requires work.

Contact Us

Latest Articles on Vanuatu

Stay up to date with the newest insights on Vanuatu property, business, and lifestyle. From affordable land tips to investment guides, these articles keep you informed and ready to take action.